Behind the scenes of a 7 figure deal

Guest post!

Today we have a guest post by fellow sales chad, BowTiedCocoon. Not only did he close his largest deal ever (ACV 7 figures) but it was a whale account that nobody thought was closable. In this post he shares what happened behind the scenes to get the deal done. Enjoy!

How did I find myself in Enterprise sales?

After college, I went straight into Management Consulting. I came across the book "Efficiency" by @BowTiedBull around that time. I ran the basic math suggested there, and it hit me like a ton of bricks - after dividing my annual salary by the number of hours invested in my career, I realized I was clearing less than minimum wage. It was not going to get much better with time. I needed to prioritize my life and make more money more *efficiently*.

Couple months later, I found myself on a sales floor. I felt like I was in some sort of Hollywood movie. New guy on the block, extremely young and doing better than people that were there for *years*. The company noticed my consistent performance. Sales trainers started using my calls to teach other reps. VPs were giving me kudos. The truth? I couldn't explain why or how I was doing any of it but it gave me confidence to push myself further.

My goal became clear: transition from Volume Sales to Enterprise Sales. Volume and Enterprise Sales are entirely different beasts. Volume sales is highly predictable, and is 95% about slamming the phone in your corner (<$15k deals). Enterprise sales is significantly more collaborative, intricate, and complex ($50k to 8-figure deals).

Getting to Enterprise was the easy part. However, unlearning everything and *sucking* at it for an extended period of time was HELL. I remember my first Enterprise deal. I got shredded to pieces by the CEO in front of his VPs and my leadership... Doubt creeped in and I almost cried when I exited the room. I’ll never forget that day.

This was a rite of passage. My mentor warned me with his stories of being bullied in the past and how you simply get over it. People at the top of the food chain did not get there by chance. The good news, every minute spent in their presence can provide a 1000x ROI for your career & personal life.

Despite all the doubts and stress, something clicked. I realized that getting into the top percentile of sales performance and clearing obscene amounts of money was within my reach. The Enterprise Sales world is filled with sharks. And in order to succeed, I needed to fill my knowledge gaps and become more resilient. I needed to evolve.

Fast forward a few years I’ve closed my largest ever enterprise deal at over 7 figures. Here are the 5 lessons I learned during that process:

Lesson 1: Sometimes the obstacle is the opportunity

While the BD leadership was wrestling with 2022 planning in late Q4, I decided to run it hot so I convinced an Enterprise Director to hand me one of the last whale accounts in our books. He agreed without hesitation because he knew what I did not.

1) We had failed 3 years in a row to land the account

2) their CEO is egotistical and got hostile with our last AE

3) the account has been in an exclusive partnership with a competitor for 5 years

4) we pushed our most aggressive offers during the 2021 bull market.

5) our organization’s north star was profitability as opposed to growth at all cost (forget the days of losing money on strategic deals to win market share).

Few hours later I got the Salesforce notification that the account has been assigned to me. Let the games begin. The deal I got? Can of worms. The lesson? Take a deep breath, suck it up and embrace it! There is hidden gold in learning how to overcome the personal biases from top executives with huge egos, understanding why deals go south and how to turn the situation around.

*

**Success Probability = Low – Overcoming a personal bias from a Decision Maker at the top of the food chain is a real obstacle to overcome and *usually* a complete waste of time… However, sometimes you need to take the leap of faith.

Lesson 2: Avoid The Common Pitfalls In Researching The Account

With the deal assigned to me, the next step was to research the account and pinpoint the real reasons the deal went sideways in the past. The CEO and his team had critical details they could use against me should we begin the negotiation process again. I needed access to this intel in order to improve my odds (*pro tip: start thinking of your deals in terms of probabilities or NGMI).

Why did the previous sales team fail at closing this deal?

What mistakes were made?

What's the context of the deal?

These were the questions that only the previous sales team in charge could help me answer - so I chased them down::

Account Executive: I messaged the previous AE on Slack… “Account Deactivated”. Shit. I look him up on Linkedin and learn he's working at a tech run by the Paypal Mafia….Inmail sent.

BD Director: If the AE is no longer at our company, what about his boss? Bingo! He’s still around. Leaders rarely get into the weeds of any deal, and as expected he provided little actionable material. However, he was nice enough to pull the pricing shared with the prospect last year.

*BIP*... Linkedin Notification from the Account Executive: “let’s do it, got 10mn now?”... After our quick call here’s what I learned:

Negotiation Style: The CEO is a pitbull: dominant, fast paced, gives 1-word reply, his way or the highway.

Champions: While the CEO is the main gatekeeper, the second and third DMs in line are the VP of Finance and VP of Marketing. Both were involved in earlier negotiations and were more “reasonable”.

Previous Pitch Content: Discussions were mostly informal - little to no discovery/analysis went into the first attempt (Surprise surprise! 🤡)

Exclusivity Termination Timeline: The prospect signed an exclusive partnership with a competitor. Their partnership will come to term in March 2023, meaning I had Q1 to win this.

Recap: After a few hours researching the account and connecting with the previous AE and his manager, I broke down the situation to a few main items:

Timeline? Q1 was the last window to win this deal before the account is contractually locked by our competitor. Time was not on our side.

Decision Making “Map”? CEO = Gatekeeper; VPs of Finance + Marketing = Champions and leverage points (**given bear market, Finance VP decision power grew)

Styles: Basic understanding of personality types and negotiation styles

Pitch: Previous conversations were mostly big picture and catered to CEO (hint hint: first attempt failed to incentivize the VP’s to fight for the deal)

Wasn’t just about the money: Prospect turned down an extremely aggressive (and generous) offer (Pro tip: people buy for their reasons, not yours!).

Previous Deal Strategy: Identified the commercials around the previous offers

+BAD NEWS: Given our company's focus on profitability and fear of a recession approaching, our Finance team refused to match the offer we made last year. In short, if I was going to win this, it would have to be at a HIGHER price point than what they turned down last year…

The Lesson? Researching accounts can be dreadful and time consuming but a necessary step to avoid common pitfalls and drive the type of conversation that leads to shaking hands on a deal.

Here is a quick list of things to focus on:

a) business priorities (10-k filing, champion)

b) size of prize if solution is deployed (build an informed P&L projection associated with the impact of your solution)

c) DMs personality type

d) Blockers and expected second order effects

*

**Success Probability = 5% – Deep Account Research can help you uncover important context that will tangibly increase your odds of success. The deal was less dead now.

Lesson 3: Go Straight For The Jugular To Break Into The Account

After researching the account, it was now time to set the strategy to break into the account.

Past strategies failed.

Pulling down our pants to show how big and great our company was? Failed.

Name Dropping some of the big logos we were working with ? Did not move the needle.

Pushing aggressive pricing? Eroded our status and value in their eyes. This time I took a more scientific approach and fleshed out the P&L impact associated with the deal.

The idea was this: calculate the Top Line (net new revenue) and Bottom Line impact (net new profit) of breaking their exclusivity and adding us to their list of vendors/distribution channels.

If the number worked out, I’d win over the VP Finance, and the CEO won't be able to turn down a lucrative business opportunity with enough zeros (or so I thought)

72 hours later after countless zoom meetings, the model was ready.

In short, this partnership would enable 50% growth of their [redacted] business, adding $11M in revenue and $8M more in their bank account (profit) by the end of our first year.

I pitched the story to the Sr Director that handed me the deal. He liked the approach and suggested running the model by some genius in the Deal Desk Department to ensure there was no hole in my math. I did. No holes.

The meeting was set for the following week with the CEO.

The Lesson? Go straight for the jugular by identifying what matters most to the client and to the decision makers at play.

*

**Success Probability = 15% – The benefits from this partnership were clear. It provided substantial upsides at a time of high levels of uncertainty (2023 recession). The projections were rooted in rock solid data that we had *no issue* sharing with their Finance VP. My aim was to frame this deal in a way that each stakeholder would rally behind it.

Lesson 4: You don’t ask you don’t get

Once the strategy was clear, the next step was to prepare the DELIVERY of the message. This is nuanced as both rational & emotional skills are needed to get through the smoke screen and tackle the roadblocks head on.

The P&L analysis was strong enough to win the deal on a rational level (top line & bottom line impact) but the approach was lacking emotional integration (**this rational approach would have likely been enough if the CFO was the main/only DM - not the case here).

To make things harder , we were also coming in with a HIGHER pricing compared to last year’s deal and had *zero* rebuttals prepared in order to address the curveball they were about to get.

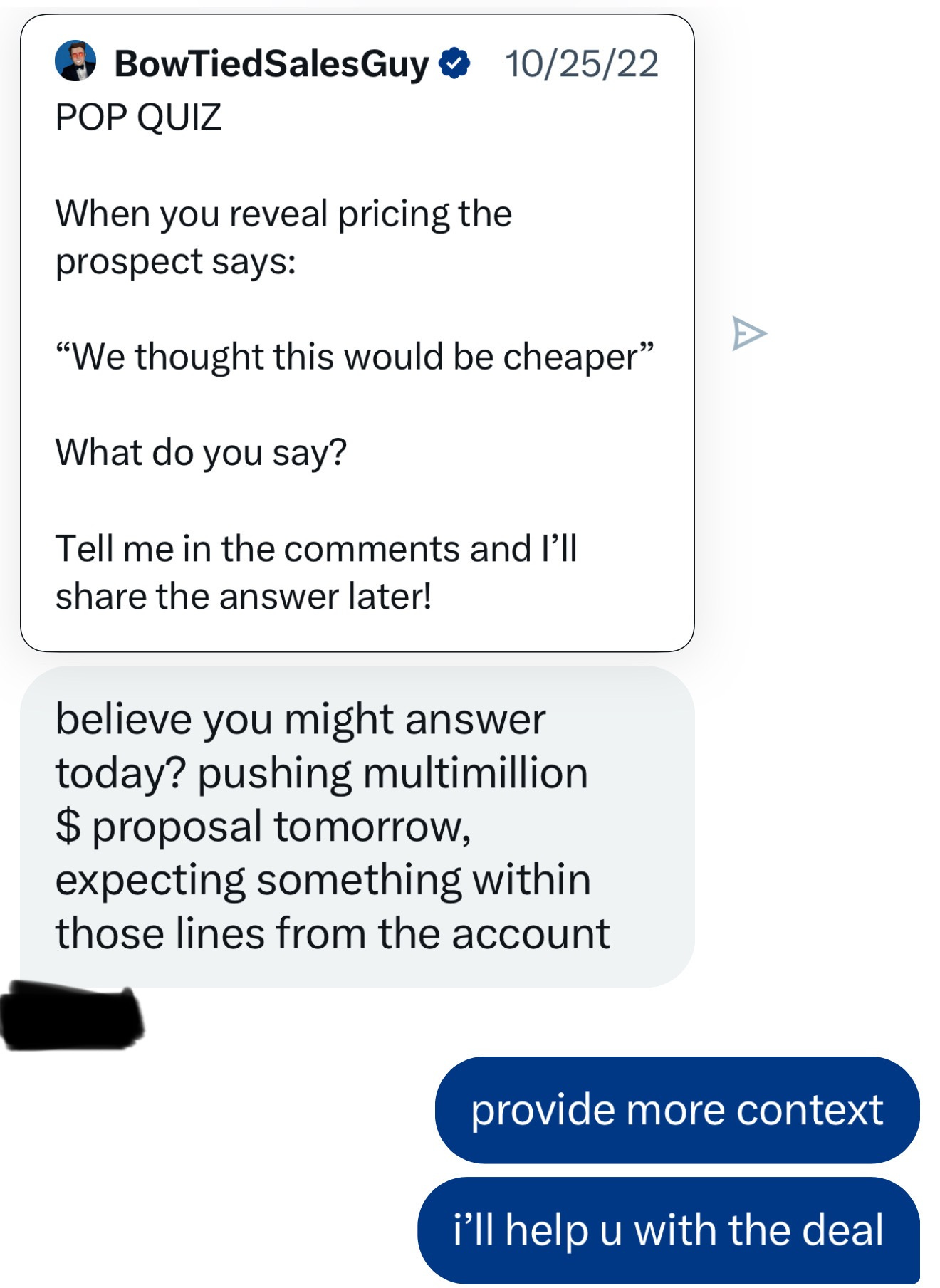

Then the jungle came to the rescue…

Lesson? ASK FOR HELP. You need to be humble and self aware enough to know where you need help. Once you identify this, you are more likely to receive the help you need.

*

**Success Probability = 25% – Going back to the basics was critical. Proactively putting yourself in the prospects shoes and challenging your (their) own arguments will dramatically improve your odds of winning the deal. The Chad Salesman Course teaches early on that DEALS are won emotionally, and rationalized logically.

Lesson 5: Lead, don’t tell!

Disclaimer: This is where the real magic happens. The most important part of the process happens when you take all the important data you gathered and turn them into clear questions that can be asked to guide the prospect in the right direction and close the deal.

I lead the prospects to close themselves by working with BTSG on these three key parts:

PART 1

BowTiedSalesGuy: “Provide more context (size of deal, client profile, blockers and expected second order effect)”

My answer:

A partnership with this client represents a +$10M business opportunity. They’re a national brand operating ~300 stores and they’re currently working with another provider on an exclusive partnership — 95% of competitors in their industry have dropped exclusive partnerships years ago and work with multiple providers because they realize they were leaving too much on the table. The decision committee is: CEO (pitbull/dominant), Finance VP (Cautious & Analytical) and VP Marketing (Analytical & Socially conscious).

Our pricing is ABOVE what they’re currently paying, but they’re better off breaking exclusivity and adding an additional provider from both a top line & bottom line perspective. I suspect they will push us hard on pricing, especially since they received an offer from us last year that was way more aggressive than what we’d be able to swing this time around.

PART 2

BowTiedSalesGuy: “Tell me the reasons they should and should not go with you”

My answer:

Reason they should work with us:

1) Negative long term outlook if they maintain status quo: they are exclusive with the only [redacted] partner that’s growing negatively YoY.

2) Benefit of breaking exclusivity: $8.1M or more in additional profit by year 1 (~20% more money in their bank for their [redacted] profit center).

3) Improved store coverage: Our service extends to regions their current [redacted] partner does not service.

4) Marketing opportunity in line with their brand strategy: We have experience doing marketing with a MAJOR baseball league they recently signed a multi-year partnership with.

5) Growth perspective: High confidence our joint business will grow double digits for two reasons: 1) Our firm is the fastest growing provider in [region], 2) We are on the verge of finalizing a massive partnership to accelerate our customer acquisition capabilities

6) Building their Ecom: They adopted a second product with their exclusive partner to grow sales, and are experiencing operational issues with the roll out. Our company IS THE NUCLEAR option when it comes to solving that specific business challenge. We created this use case in our industry - and some of the largest brands with the highest level of operational standards like McDonald’s and Walmart use us.

7) Optics: Only 2 of the top 20 brands in our industry are still doing exclusive deals. The majority understand that exclusivity leaves too much on the table and is a horrible business decision.

Reason they should NOT work with us

1) Personal: CEO had bad experience working with previous AE (he left the company) + they’ve been exclusive with our competitor for over 5 years

2) Price: We are more expensive at every level + the new proposal is substantially higher than the one they received last year.

3) Market Share: Despite being the fastest growing provider, we are still the #3 provider in [region]

PART 3

BowTiedSalesGuy: “Create questions & statements that lead them to see the points you want to make WITHOUT you having to explicitly say them”

Reason #1 Negative long term outlook if they maintain status quo

Word track #1: “I have to hand it to you. Your commitment to [redacted] partners despite their negative YoY growth rate is incredible. I’ve never seen such commitment”

BTSG note: Nice neg cocoon!

Reason #2 Benefit of breaking exclusivity

Word track #2 (personal favorite): “John help me understand why you would make the switch cause I feel like ROI isn’t the reason?”

Reason #3 Improved store coverage

Word track #3: “When [current provider] told you they don’t service xyz regions what did you say?”

BTSG note: a beautiful presumptive question.

Reason #4 Marketing opportunity in line with their brand strategy

Word track #4: How is your current provider supporting your strategic marketing investment with [baseball team]? it’d be cool to work with a provider that also has the rights to advertise within the stadium… wouldn’t it?

Reason #5 Growth perspective

Word track #5: “Help me understand where you want to get your [redacted] business, and how you see someone like us helping you get there”

Reason #6 Building their own channel for [redacted]

Word track #6: Most of the companies in your space I speak with tell me one of their top priorities in 2023 is to deploy their own [redacted] channel. I'm assuming you guys are doing something similar too?

Reason #7 Optics (perception in the industry by other players)

Word track #7: Can you think of any reasons brands just like yourself are stepping out of the traditional exclusive partnership model?

Reason #8 Personal

Word track #8: John, first off i just want you to know that bad experience with the last AE won’t happen again because [we fixed problem].. I hope that won’t be the dealbreaker.

BTSG note: adding a suggestive statement that *feels* personal can be powerful in the right context as cocoon demonstrated.

Reason #9 Price

Word track #9 “John my biggest concern is even if we showed you the best deal terms in the world your dedication to your current vendor is insurmountable”

BTGS note: Bingo. Let them overcome their own objections!

Reason #10 Market Share

Word track #10: Can you think of any reasons why [competitor 1,2 or 3] decided to work with us?

Cocoon note: write all these word tracks out, practice delivering them so you feel the confidence.

BTSG note: Notice how there are more reasons for the prospect not to move forward than there are to move forward. This is the alfa. You work through the negatives which improve your odds of them accepting the positives.

🤡 Before running this process: The million dollar question to win this deal was: “How many dollars will they make in Year 1 from this deal?”

🐲 After running the process: The million dollar question became: “Why didn’t he take the last offer, and why the f*ck is he on this call now? What changed?

BTSG note:

Turns out the ROI was not the primary motivator, otherwise they would have taken last year’s deal. Today the deal is sealed and the contract is signed by all parties (pro tip: the negotiation will continue through the redline process. Stand your ground.)

What helped win the deal? It’s impossible to go into the intricacies of the deal without doxxing, but it had something to do with figuring the path to keep ONE benefit from their exclusive partnership in our new deal. This was only discovered because I challenged them in order to find the truth.

–

**Success Probability = 50% – At this point, the approach encompasses *both levels* necessary to win. There is an informed use case that speaks to their (1) rational level,. On the other hand, there is a clear path to (2) effectively address the emotional and negative bias (human element) that stood in the way of us working together. While nothing can ever guarantee success, incorporating both the rational and emotional elements of the deal will increase your chances of success.

Final thoughts

From a probability standpoint I should have never jumped on the account. One of the silver rules in sales is don’t bother trying to win people over who don’t like you! @BowtiedBull Note (paraphrasing): There are thousands of companies in the world and you’re better off going after that blank canvas than trying to clean off the mess that’s already in front of you. The math is pretty clear. Once someone doesn't like you it takes 3x as much effort to turn it around. That means you could have three more contacts instead of one fixed contact.”

Enterprise Sales IS a different beast than lower ticket / simple sales. You need a more systematic process in order to win. The lessons learned show that there is a repeatable process at each level of closing a new deal that can be refined and relied on. You can embrace the steep learning curve and get increasingly nuanced at going straight to the heart of what matters most for each part of the process.

If you want to become more proficient at enterprise sales then, I recommend the Chad Salesman course. It transformed my sales approach and helped countless folks in the profession save time and win more deals.

If your goal is to break into Enterprise Sales or move upmarket? check the BowTiedCocoon course. It’s actionable steps you can implement immediately to help you land a +$100,000 sales role at F500 companies and unicorns, regardless of any specific background. Also, there is opportunity for more personalized mentorship [link].

You can find me on twitter at @BowtiedCocoon or sign up for my upcoming email newsletter where you can learn about my future posts.

Yours truly,

- BowTiedCocoon

it's a joke how legit y'all are.

source: i'm a tenured Strat AE from Tier 1 SaaS (rhymes with "schmalesmorse")

Really nice article. Thank you both.