Q&A Write-up: April

First you differentiate, then you win.

Q&A’s happen once a month where I answer one of the paid subscribers questions and do a write-up answering it for the entire community.

April’s question:

I sell compliance software. My competitor has a larger share of the market in large part that they were faster to market with a sleek UI/UX. We’ve made some huge investments in this area to play catch up, but I still lose deals because the competitor looks easier to use, especially for low touch users. It is one of my competitor’s biggest selling points against us. Where am I going wrong here? I’ve tried to do a better job of qualifying and also seriously simplify demos, but curious how you would either overcome this objection or get in front of it.

Initial thoughts

You have 2 (legitimate) disadvantages here:

Competitor has a first mover advantage

And a better “perceived” UI/UX

The problem of “looking easier to use” is actually marketings and products fault.

What are product & marketing doing to communicate and promote the product improvements to prospects?

At the bare minimum, you should have access to content that showcases / promotes how sleek your UI/UX is and how easy it is to use while touching on other advantages & differentiators.

This includes but is not limited to:

Pre-recorded demos / walkthroughs

Specific use case / Spotlight videos

No decks!

Buyers need to see and experience the product in action through video, live demos, trial access, etc.

The idea here is to send this type of content to leads before meeting them and ask them to review the demo and come to the meeting prepared with follow up questions.

This may help with converting both low touch users and your regular leads.

—

Now let’s focus on some immediate Tactical things you can do.

Tactics

One thing I’d immediately stop doing is talking about all the major investments you’ve made into your UX/UI in your sales meetings.

You won’t win no matter how hard you try to convince them on ‘ease of use’ because it will always be in comparison / contrast to a “superior” alternative.

Best not to go there. Playing catch up makes you look weak.

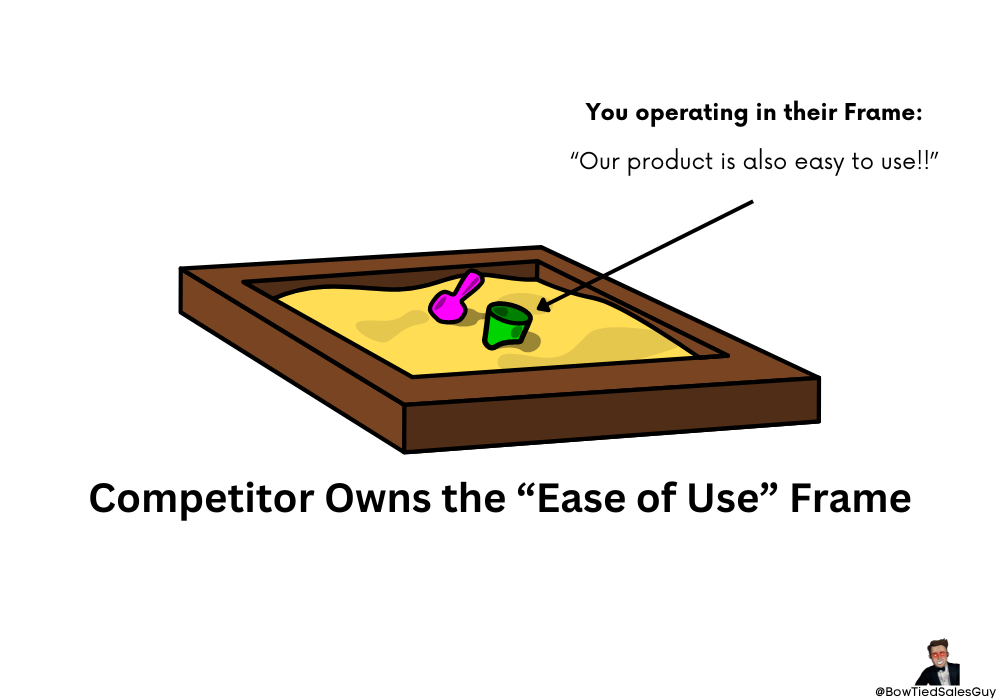

Continuing to do that solidifies you operating in your competitors Frame:

They currently own the “Ease of use” Frame (Perspective)

So stop playing in that playground.

Create a new one that you can own.

Now if the buyer asks about / mentions “Ease of use” you can always Reframe by saying something like:

🐲: You know.. we’re always making investments into our platform.. which obviously includes product improvements and upgrades.. some of which you’ll see on the demo.. assuming we get that far of course.. *asks next question*”

Breakdown:

“always making investments” sub-communicates awareness, dedication, and trust to the buyer.

“includes product improvements” implies ‘Ease of use’ wasn’t the priority (which is good because you’re not directly admitting fault and putting yourself in a low status position) + creates some intrigue into how else you improved the platform

“some of which you’ll see on the demo” again stacking the Intrigue here that you’re only scratching the surface of your platforms capabilities

“assuming we get that far” = a subtle neg

Take time engineering and memorizing your Reframes.

It will serve you well.

—

You must also get in the habit of gently pushing the buyer away..

🐲: There must be a reason you haven’t gone with [competitor] yet? .. What were you hoping to see or hear from us that is different than what you saw with them?

Challenge whatever they say:

“How important is that [reason they give you]? Why?”

“How do you define that?”

“And you need that because?”

etc

Strategy

I recommend finding a different lever of influence than ‘ease of use’ (because that selling point is now owned by your competitor)

I’d first start by asking paying customers these types of questions:

🐲: A bit of a weird request.. I’m always wanting to learn more and understand how we can better help our clients. Would it be alright if I ask you a few questions to better understand your use case with us?

“What were the reasons you chose to work with us?”

“You could have went with [alternatives].. why us?”

“What did you see or hear from us that was compelling?”

“What did you see or hear from us that wasn’t as compelling?”

“And how about during the demo? What were the 1-2 features or functionality you liked?”

Then with new leads, you can either play to the reasons your existing buyers gave you directly (by emphasizing certain features/function/etc) or indirectly (“I felt you guys were the right option for us”)

Then I’d ask prospects:

🐲: Aside from ease of use, what are the most important things you’re looking for in a new vendor?

🐲: Walk me through your evaluation criteria? What criteria are you using to ensure you’ve chosen the right vendor?

🐲: And what’s the weight of that criteria / How is that prioritized? / How does that stack rank?

🐲: How else will you know when you find the right vendor? Or is it just checking those specific items like [specific items they told you earlier] off your list?

^ Most buyers will dig deeper to answer this in order to avoid commoditization. Few.

Why would a buyer choose to buy your software over the competition? (aside from ‘ease of use’)

You need a compelling answer(s) to this question.

—

Next, I’d talk with R&D.

Ask them about the technical differences between your software and the competitors.

What advantages does your software have over the competition and how does that translate into points your buyers also care about?

Get into the minutiae with your team because that’s often where the gold is.

I wrote more about this here re: commoditization in a technical sale:

Bottomline

You need to discover your real differentiators that the buyer values in their evaluation criteria and then play to that.

Can’t just be ‘Ease of use’

And ‘price’ doesn’t count either

Think about features, functionality, and reliability.

You sell to compliance?

Their DISC profile is C for Compliant / Conscientiousness

And what are the C’s biggest fears?

Making mistakes.

Play to that by Framing your software as a way to avoid their fears from happening.

—

Use sites like G2.com to also assist you in discovering the differentiators.

*I’m not affiliated with G2.

Here’s an example using DocuSign’s profile on G2 to illustrate the type of information that you may able to see in your space too:

You can click into any of these categories and read real reviews.

G2 can be a real goldmine of information so I suggest reading through your competitors reviews, pros & cons, and compare it to your company’s reviews and profile.

Only once you’ve done deep research and have all of this information can you begin to differentiate.

Reach out to me if you want additional help.

-BTSG

Awesome stuff! Appreciate the insights here BTSG